The Korean Music Copyright Association recently teamed up with one of Korea’s largest accounting and consulting firms, EY Hanyoung, to dive deep into the domestic and international music streaming markets. The findings of this collaborative research have sparked discussions around the revenue distribution framework for music creators in South Korea.

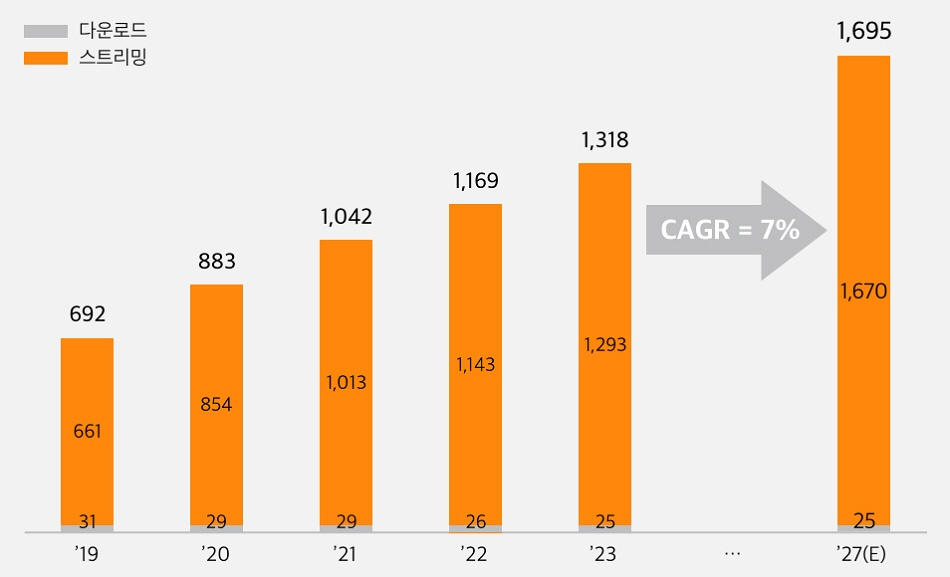

According to the report, the growth of the domestic digital music market has been impressive, soaring from approximately $700 million in 2019 to $1.32 billion in 2023—an almost twofold increase that has now made it larger than Japan’s music market, a leading hub in Asia. Notably, the streaming sector has been the main driver of this growth, witnessing nearly 100% growth over the past five years.

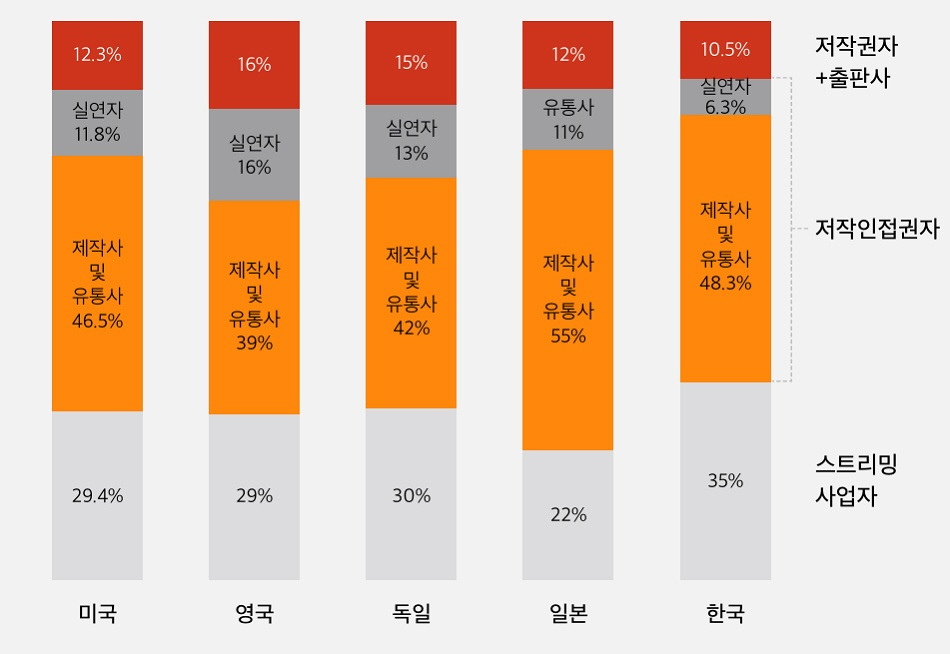

However, despite the booming market size, the share that creators actually receive remains alarmingly low. In the U.S., artists get 12.3% of streaming revenues; in the UK, it’s 16%, and in Germany, 15%. But in South Korea, that figure is just 10.5%—1.8% to 5.5% lower than its international counterparts.

The disparity in earnings is even more pronounced when looking at the overall streaming revenue structure. In these other major markets, the income share for streaming platform operators stands at about 29% in the U.S., 29% in the UK, 30% in Germany, and 22% in Japan. In contrast, South Korean platforms take home a staggering 35%, leaving creators with a smaller slice of the pie.

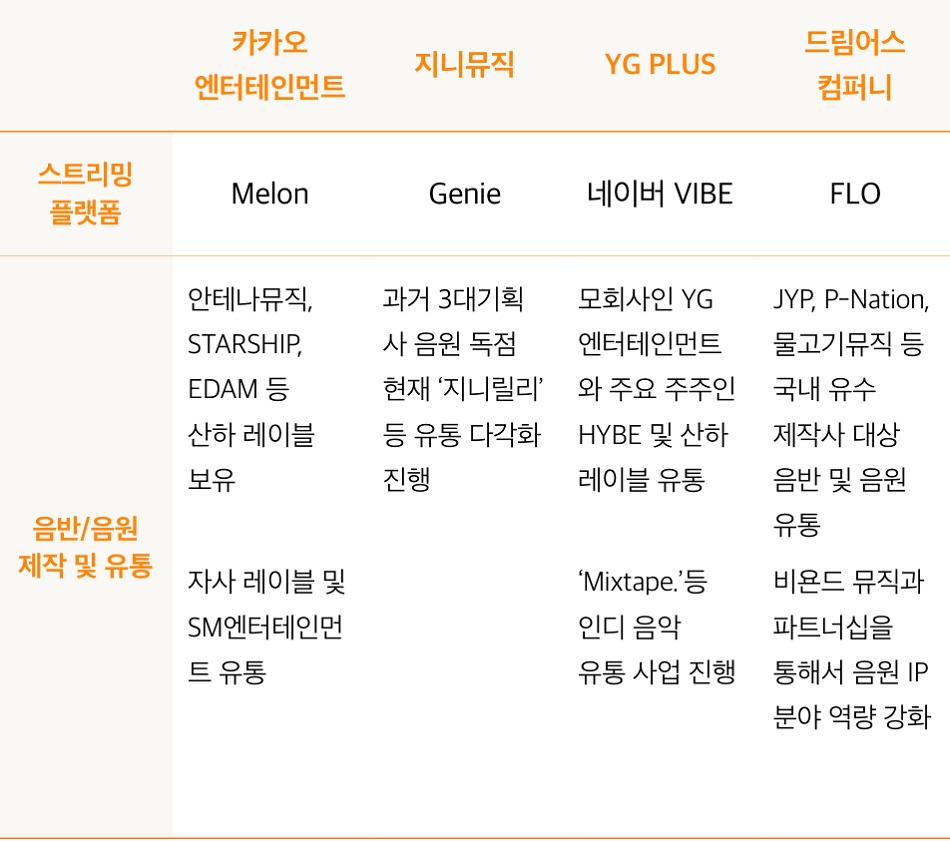

Adding to this imbalance, the leading domestic streaming platforms operate a vertically integrated model that allows them to capture over 83% of streaming revenues. When musicians see just 10.5% of their earnings, the gap is painfully clear.

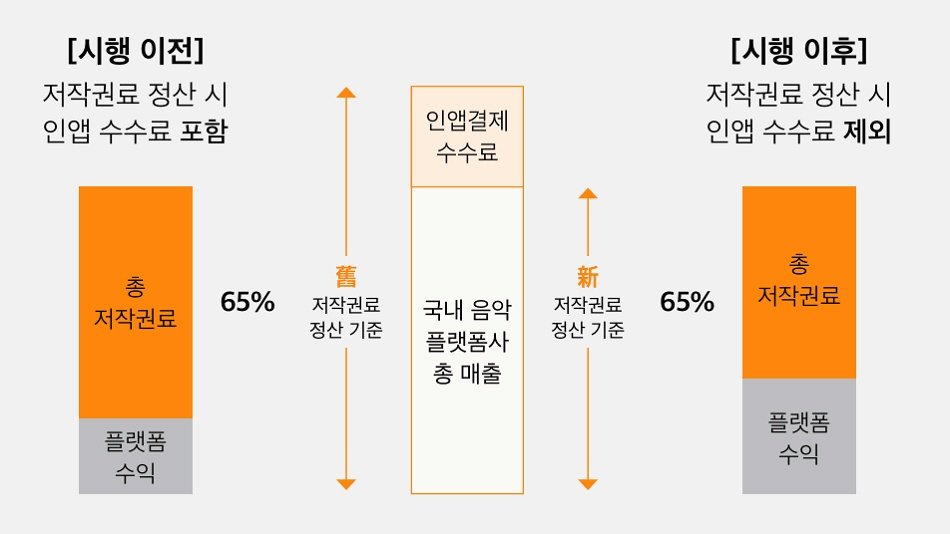

In light of these troubling figures, it’s concerning that government policies seem to favor platform operators over protecting creators. A prime example is the “Music Copyright Revenue Sharing Plan” initiated in 2022.

This initiative’s core tenet aims to exclude the “in-app payment fees” paid to app market operators like Google and Apple from the revenue used to calculate copyright fees. Previously, copyright fees were set at 10.5% of total revenues, but under this new approach, the fee percentage applies only to the revenue after excluding these charges.

Unfortunately, this has placed an additional financial burden on copyright holders, who are already receiving a minimal share of streaming revenues. The backlash has led to criticisms that the “coexistence plan” essentially sacrifices creators for the benefit of platforms.

This measure has been extended into 2024, with the copyright rate remaining unchanged, yet the base revenue is set to decrease, ultimately leading to a reduction in creators’ actual earnings.

Meanwhile, various countries are strengthening protections for creators’ rights. For instance, the U.S., the largest music market globally, plans to raise streaming rates to 15.35% by 2027. They’ve also revamped copyright laws since 2018 to impose penalties for late payments, enhancing protections for creators.

An industry insider remarked, “As the digital music market continues to grow, protecting the rightful claims of creators is essential for fostering a sustainable ecosystem. We will actively advocate for improved fee structures and policies that benefit copyright holders.”